Money Addictions

What are “Money Addictions”?

Money Addictions are addictions that need money to make them happen. The money is not the addiction itself, it is actually used to fuel the addiction. Two of the most notable Money Addictions are Shopping and Gambling.

How do I manage “Money Addictions”?

In short, here are 3 different strategies for you to try: Be Decisive, Control your Money OR Limit your Access. These strategies are all explained in further detail under the tabs above.

How do I “Be Decisive”?

Being Decisive involves making a decision or a plan on what you are going to do with your time or in this case money ahead of time and sticking to that plan. To help you do this, I have broken this down into steps below:

Don't be lured in

The first thing you have to do is understand that shops and gambling outlets are there to take money from you. They will try to lure you in with special offers or offering you 1 more (another item or another game), 1 more too many. I’ve tried playing claw machines for a plush toy I liked. I had seen people just win at them which told me it was possible but even though I managed to grab the plush toy it would never come to me. In the end, I realised it would be easier to buy a plush instead.

Focus on what you NEED

When I was a kid and it was Christmas, I would always ask for toys or video games as they were what I wanted. As I’ve gotten older though, I have realised that the focus of my wants and desires should be on what I need to benefit my life. This means I now focus on buying or asking for (at Christmas and on my birthday) things that I need such as a chest of drawers which I can use to store and organise things.

Make a List BEFORE you start shopping and stick to it

When my cousin and I did our food shopping, we always went to get what we thought we needed but we also got distracted by looking and buying other things we didn’t need leading us to waste more time shopping and dragging it out. To combat this, we started making a list of stuff we needed by looking around our house first beforehand so we wouldn’t waste time and money.

Procrastinate on shopping and gambling

This may sound counter productive to procrastinate on something but as autistic people we always procrastinate on things that are helpful to us and never procrastinate on those things which are unhelpful to us so perhaps it’s best to focus all of our procrastination on our negative habits instead.

How do I Procrastinate on shopping and gambling?

This can be as simple as saying you will shop and gamble later. For me, I have seen things I want to buy but then I have said to myself “I’ll come back for it another day” and by saying this I have taken the pressure off myself to compulsively buy something and give myself the time to think about whether or not I want or NEED the thing that interested me in the first place.

How do I “Control my Money”?

Controlling your Money involves looking at how money is used to make payments (usually through cash and cards) and then find ways to reduce or block these payments. To help you do this, I have broken it down into steps below:

Set a Budget

Every year I go to Comic Con. When I go there, I always prepare by working out how much it will cost me to get autographs from the famous people attending first (as they are the main reason people attend) and how much I want to spend at the shop stalls, then I take the money out accordingly. I budget it as half the money for autographs, half for the stalls and I take extra just in case.

Take only the money you need

When I have my budget sorted out for comic con, I take money with me in the form of cash so I don’t get tempted to spend more than what I have in hand and this keeps my budget on target.

Leave your cash card(s) at home

My cousin once had issues with controlling her money spending as she found that by having her cash cards with her that she felt constantly tempted to spend money. To stop this, she started leaving her cash cards at home as without them she couldn’t wildly spend.

Leave your cash card(s) with someone trustworthy

My cousin found that leaving her cash cards at home was something she couldn’t keep too. Instead, she gave her cash cards to her mother who would agree a budget cash mount to be withdrawn and make sure my cousin could not access her cards after that.

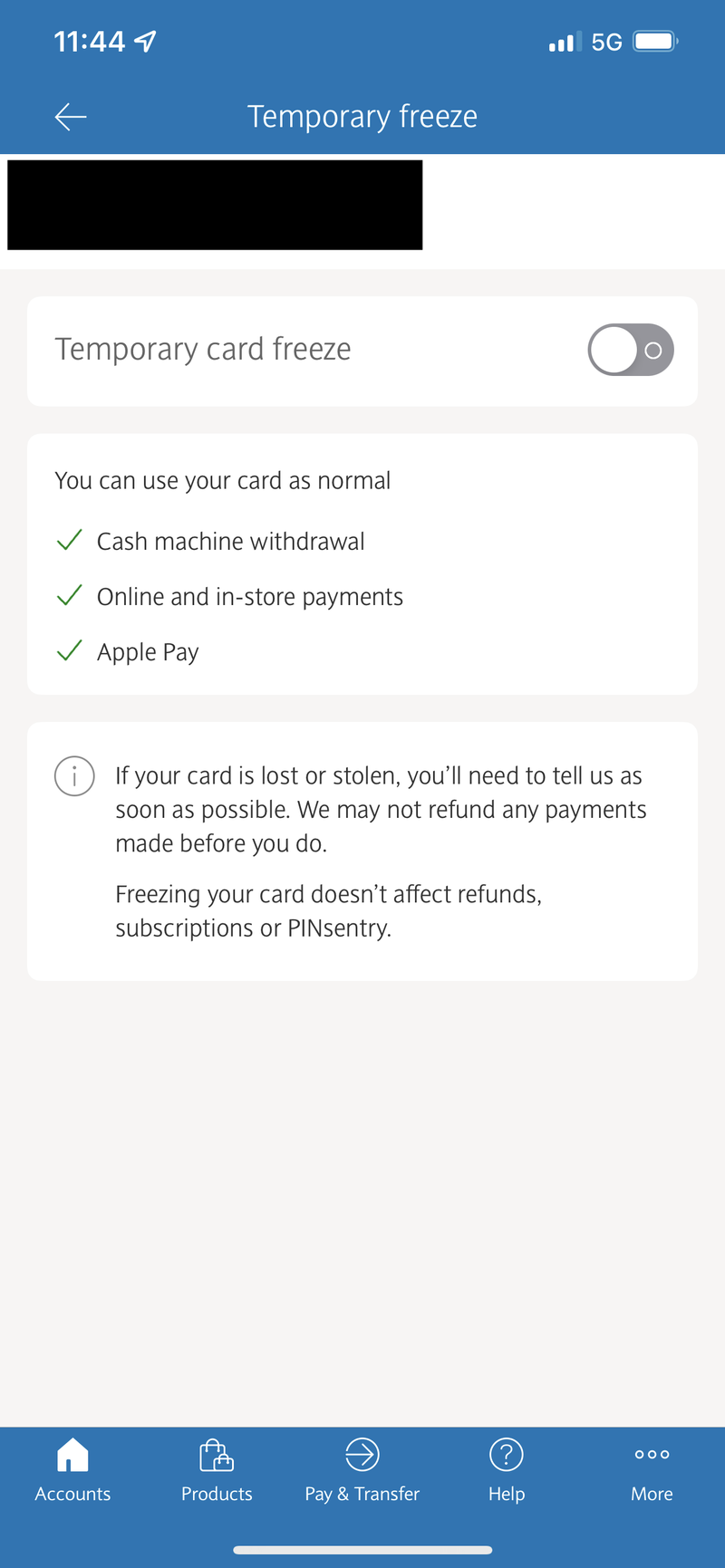

Freeze your cards temporarily

In doing research for money addictions, I learned that if someone loses their cash cards and uses a phone banking app, they can temporarily freeze their cash cards to prevent any unauthorised spending of their cards. I believe that this can also be used as a way to prevent the card’s owner from being tempted to wildly spend.

How do I “Limit my Access”?

There are two ways to access Money Addictions: Online and Offline. Online access involves spending money over the internet whereas Offline access involves spending money in a physical location such as a shop or casino. To help you do this, I have broken down both types of access into steps below:

(Online) Use Safer Gambling tools

This applies to gambling more than shopping. A lot of gambling websites nowadays offer online tools to help you keep control of your gambling such as a budget setter and time out feature which will throw you out of your gambling account and lock you out for a certain amount of time, forcing you to take time away from the addicting website.

(Online) Delete your accounts

This is one of the quickest and easiest ways to deal online money addictions just like with electronic addictions. If you have an account to a certain website that is the centre of your addiction, then deleting it will stop you from being able to immediately use it.

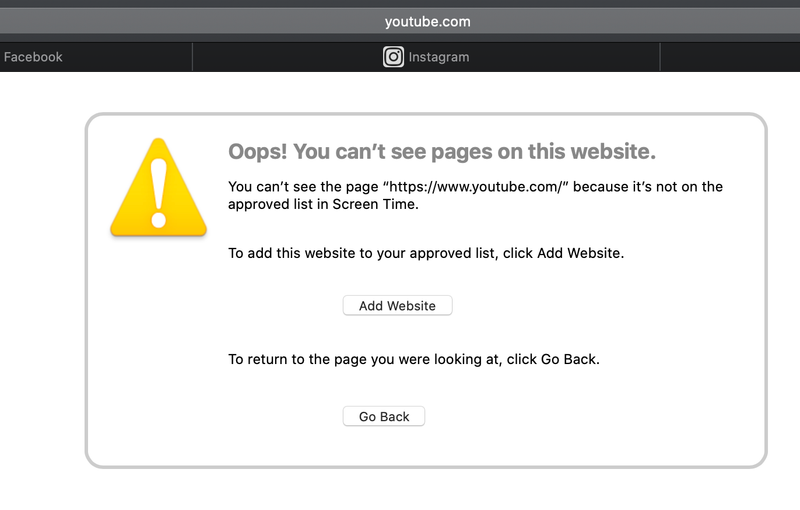

(Online) Block the addicting websites

For good measure, after deleting your accounts, it will be a good idea to block the websites as a double security measure to protect yourself against the addiction.

(Offline) Stay away from places that trigger your addiction

There are a few places I love to visit in my city such as a gadget shop and a video game shop. I know that if I enter these places, that I’ll start looking for something to buy so I realised that if I don’t want to buy something then I should avoid going to these shops by taking a different route around my city, even if it takes me longer to get to where I NEED to go.

(Offline) Self-Exclude yourself from gambling places

Self-Excluding yourself means asking gambling places not to allow you inside. You can do this by contacting or entering the gambling place and declaring that you want to self-exclude from them. This is only way you can block yourself from a gambling place physically.

You control the Addiction not the other way around.

Always remember, you are stronger than your addiction, you have the power to overcome it. Take back control of your addiction, don’t let it control you.